Innoviva Board Recommends Shareholders Vote "FOR" All of Innoviva's Qualified Directors on the WHITE Proxy Card

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20170417005337/en/

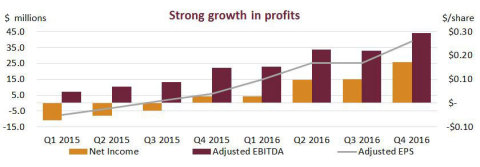

With strong and consistent growth in profits,

Dear Fellow Innoviva Shareholder:

The Annual Stockholders Meeting of

YOUR QUALIFIED AND INDEPENDENT BOARD HAS A STRATEGY THAT IS PRODUCING RESULTS

YOUR BOARD IS RESPONSIVE TO SHAREHOLDER INPUT

"We support

We also welcome feedback on how to continue to deliver value for the

benefit of our shareholders. As a result of our recent conversations

with shareholders, your Board has determined to undertake a fresh,

comprehensive review of all of our costs, including executive

compensation structures. Your independent Board looks forward to

continuing our active dialogue with all

SARISSA'S SHRILL ATTACKS AND FALSEHOODS

In sharp contrast to our approach to shareholder engagement are Sarissa's repeated falsehoods and distorted attacks. When Sarissa launched its proxy fight without prior notice, it raised none of these issues with the Company - and in fact lauded Innoviva's management in private conversations. But in its attempt to distract from its self-serving agenda, Sarissa issues daily press releases with "fake facts."

Here are the real facts.

1. Active management:

-

The core of Sarissa's attack is its claim that

Innoviva is a check-cashing royalty company. That's what Sarissa relies upon to justify its misguided attack on compensation and costs. This is flatly false. - Our partnership with GSK requires us to actively participate in managing and overseeing the development and commercialization of the collaboration products. This is evidenced by the fact that our management team had more than 70 in-person meetings/calls with GSK in 2016-2017.

"GSK has been a long-time partner of

- The fact that GSK has a "tiebreaking vote" on issues involving the partnership is the thin reed on which Sarissa has to hang its argument.

- As our longstanding shareholders know, our strong, collaborative partnership with GSK has been the key to Innoviva's growth and opportunities for the future. Sarissa's attempt to replace our management team and strategy would jeopardize our profitable GSK partnership at shareholder expense.

2. Cost and compensation structure:

- Your Board and management team are committed to responsible cost control.

- We have maintained our cash costs year-over-year from 2015 to 2016 and are pursuing cost reductions in the future through a fresh, comprehensive review of all of our costs to be led by our Board, as mentioned above.

-

To distract from the real facts and create a false narrative, Sarissa

uses highly misleading arguments to attack compensation, including

comparing

Innoviva to Enzon. Enzon has zero employees and a$10 million market capitalization (less than 1% of the value ofInnoviva ). Yet, Sarissa portrays Enzon as more complex because it collects royalties from more drugs. - Annual incentive awards for management are based on achievement of specific performance goals with a substantial portion of their compensation tied to total shareholder return performance - aligning management's incentives with shareholder interests.

- Say-on pay support from shareholders exceeded 90% in each of the last three years.

3. Access to

- Sarissa has had 6 conversations with our independent directors since it launched its proxy fight.

-

Mr. Denner tries to argue that our independent directors were inaccessible, when we have been in near constant dialogue - except for whenMr. Denner was not available (10 days due to a cold and for 10 days during his trip toEurope ). Sarissa's assertion of our lack of effort to meet with its candidates is not supported by the facts. -

Sarissa insists on nominating directors who are not as qualified as

Innoviva's directors - and each of Sarissa's candidates recently

presided as a director of a company that was delisted. We still

are open to a successful resolution with

Mr. Denner , but only if it is in the best interest ofInnoviva shareholders.

4. Governance:

- Our Board is highly engaged and deeply involved in the business and oversight of the Company - with 18 Board meetings in 2016.

- Our Board is comprised of 4 current or former CEOs, 2 former CFOs, 6 directors with relevant industry experience, 5 directors with M&A experience - and most of our directors have been added in the past 3 years.

- In the process of adding new directors, our Nominating/Corporate Governance Committee had many formal and informal meetings (including with the full Board) which led to excellent results: the successful addition of two qualified independent directors to our world-class Board.

-

Contrast Innoviva's directors with the slate

Mr. Denner initially nominated - his junior partner, his general counsel, a film executive and a director who served with him on other boards. And there is no diversity among Sarissa's nominees - the only criterion for being "Sarissa-worthy" seems to be having close ties toMr. Denner .Mr. Denner deserves a failing grade for his selection process for board nominees.

5. Value destruction by the Sarissa team:

-

Mr. Denner and his team destroyed shareholder value at Enzon - stripping it of assets and turning it into the check-cashing company that he wantsInnoviva to be. -

After

Mr. Denner took control of Enzon and implemented his strategy, he delivered an 81% decrease in revenue and an 82.9% decrease in value during his tenure. -

Now, Sarissa blames products, the market and various other reasons for

the value destruction - every reason except for their own failed

strategy.

Mr. Denner fails to apply his standard for accountability to his own team's failures.

6. Sarissa trying to take effective control of

- Sarissa originally launched its proxy fight by nominating 4 directors for our 7-person Board.

- More than a month after Sarissa's original nomination, Sarissa dropped its general counsel from the slate after officially launching its proxy fight.

- Sarissa is still demanding 3 of 7 seats of our Board, a change in strategy and replacement of our CEO and Chairman. Additionally, Sarissa has publicly requested the resignation of a fourth director.

- Sarissa's argument that it is not trying to oust management and take effective control of the Board is, like most of Sarissa's attacks, simply not supported by the facts.

Now That You Have the Facts: Who Do You Want to

We urge you to protect the value of your

Sincerely,

The Board of Directors of

|

Your Vote Is Important, No Matter How Many or How Few Shares You Own! |

| If you have questions about how to vote your shares, please contact: |

|

INNISFREE M&A INCORPORATED |

|

(888) 750-5834 (TOLL-FREE from the |

|

or (412) 232-3651 (from other locations) |

|

Banks and Brokers May Call Collect: (212) 750-5833 |

|

REMEMBER: |

| Please simply discard any Gold proxy card that you may receive from Sarissa. |

| Returning a Gold proxy card - even if you "withhold" on Sarissa's nominees - |

| will not help your Company, as it will revoke any vote you previously submitted |

|

on Innoviva's WHITE proxy card. |

|

Please visit http://investor.inva.com/proxy.cfm for more information. |

About

ANORO®, RELVAR®, BREO® and ELLIPTA® are trademarks of the GlaxoSmithKline group of companies.

Forward-Looking Statements

This press release contains certain "forward-looking" statements as that

term is defined in the Private Securities Litigation Reform Act of 1995

regarding, among other things, statements relating to goals, plans,

objectives and future events, including expected cost savings.

Reconciliation of Non-GAAP Financial Measures to GAAP

In certain circumstances, results have been presented that are not

generally accepted accounting principles measures ("Non-GAAP") and

should be viewed in addition to, and not as a substitute for, Innoviva's

reported results.

Please see the reconciliation that follows for additional information and the reconciliations of these non-GAAP financial measures to the closest GAAP financial measures.

|

Reconciliation of GAAP to Non-GAAP Operating Results |

||||||||||||||

| (in thousands) | ||||||||||||||

| Eight Quarters Ended | Twelve Months Ended | |||||||||||||

|

|

|

|||||||||||||

| (unaudited) | (unaudited) | |||||||||||||

|

EBITDA: |

||||||||||||||

| GAAP net income | $ | 40,776 | $ | 59,536 | ||||||||||

|

Non-GAAP adjustments: |

||||||||||||||

| Interest expense (income), net | 103,294 | 51,834 | ||||||||||||

| Stock-based compensation | 15,171 | 8,297 | ||||||||||||

| Depreciation | 240 | 131 | ||||||||||||

| Amortization of capitalized fees paid to a related party | 27,646 | 13,823 | ||||||||||||

|

*Adjusted EBITDA |

$ | 187,127 | $ | 133,621 | ||||||||||

View source version on businesswire.com: http://www.businesswire.com/news/home/20170417005337/en/

Investor Contact:

Eric d'Esparbes

Senior

Vice President and Chief Financial Officer

650-238-9640

investor.relations@inva.com

or

Media

Contacts:

212-371-5999 or 213-630-6550

pct@abmac.com

or ina@abmac.com

Source:

News Provided by Acquire Media